发布时间23rd Mar 2018

修改于28th Apr 2020

金盎司价格与一条面包价格的历史比较

七年多前,也就是 2010 年 9 月,我写了一篇关于黄金盎司价格与面包价格历史对比的文章。但我怎么会错得这么离谱呢?我有农业背景,作为投资者,这就是我的收入来源。现在,在 2018 年 3 月,我用我的新想法和经验更新了这篇文章。

七年多前,也就是 2010 年 9 月,我写了一篇关于黄金盎司价格与面包价格历史对比的文章。但我怎么会错得这么离谱呢?我有农业背景,作为投资者,这就是我的收入来源。现在,在 2018 年 3 月,我用我的新想法和经验更新了这篇文章。

为了历史真实性,我不会改变原文的细节。你可以在本文最下方找到它。

那么,为什么我将一条面包的价格与黄金的价格进行比较会得出如此不准确的结论呢?几个世纪以来,面包一直是人们的主食,也是影响生活成本的重要商品。但几个世纪以来,一条面包的重量超过一公斤,而今天只有 400 克,有些市场现在出售 350 克的面包。显然,我的尺寸比较完全不准确,因为大型超市降低了面包的价格、质量和尺寸!

通货膨胀

20 年来,通货膨胀率平均每年为 3.22%,这是巨大的。1776 年,美国的通货膨胀率为 29.78%,而今天的通货膨胀率为 2.1%。但请注意,当生活成本指标显示通货膨胀率上升时,股市就会崩盘。政府可以通过低工资增长来控制通货膨胀,这在过去 7 年里一直有效。

谷物成本较低

我现在才意识到我们的谷物、小麦、大麦、燕麦和玉米的价格在过去十年里是如何暴跌的。家庭农场现在被多家公司接管,采用新的经济高效的耕作方法,因此谷物更便宜,有助于降低生活成本。

但小麦已不再像以前那样。

1972 年我从农业学院毕业时,小麦有真菌问题,所以现在小麦是转基因的。我们现在也吃不到好食物了。结论:面包不像我们的祖先吃的那么好吃,他们很幸运能吃到优质食物。

这就是为什么超市现在卖的这个商品这么便宜,因为基本上是供需力量影响了农产品价格。我认为我讨论的更多的是原则而不是比较。

稳定的政府

几个世纪以来,320 到 350 面包的比较都是针对稳定的政府来衡量的。今天,我使用的几个公式的比较都表明,在今天的黄金市场上,每块黄金现货价格为 500 到 680 面包。您也可以尝试不同的公式,但我无法用数学方法计算出在今天的黄金市场上,黄金产品的价格低于 350 面包。

债务

我们的巨额债务必定是影响政府稳定的因素。目前,全球主权债务约为 71 万亿美元,除此之外,还有许多不同级别的债务,从私人到议会、公共部门和州,截至 2016 年底,全球债务总额高达 223 万亿美元。另一个统计噩梦数字是,截至 2017 年底,美国每个人欠债 61,365 美元。我们不要去那里,它规模巨大,必须、必须、必须崩溃。

黄金价格走势图

当我写这篇文章时,黄金市场很稳定。2010 年 9 月,黄金现货价格为 1247.20 美元。现在我了解了黄金市场的供需规律,但 2018 年 3 月,黄金价格仅为 1317 美元,但购买黄金的需求却很强劲。黄金价格一直停滞不前,而且有很多操纵的谣言。

但我认为谣言没有理由存在,因为当权者当然会操纵黄金市场,就像他们操纵比特币一样。2007 年,黄金价格图表仅为 688.00 美元。我们越远离稳定的政府,越倾向于负债累累的政府,金本位制就越会遭到反对。

黑天鹅事件

我们需要一场灾难来恢复金本位制并纠正债务吗?金本位制可能已经被彻底埋葬了。战争,例如朝鲜战争,大规模战争只会增加债务。英国刚刚在 2006 年 12 月还清了其巨额的二战债务,花了 61 年才还清了 210 亿英镑。

唯一的可能性是中国出人意料地将人民币与金本位挂钩,因为他们确实拥有世界上最大的金矿之一,但目前还没有准确的信息。

也许加密货币将由黄金支持?

澳大利亚珀斯铸币厂将于 2020 年推出以黄金支持的加密货币。

2018 年总结

许多商业周期都有模式或自然规律,七年周期、80-20 规则和精明的金融战术家遵循这些复杂的相互关联的趋势和未来合约。但我有一条规则我严格遵循——

占有是法律的十分之九。拥有自己的资产。拥有自己的家,拥有自己的事业。拥有自己种类繁多的黄金。购买和储存实物黄金,完全控制您的黄金产品。

**来源文章**

金盎司价格与一条面包价格的历史比较

《旧约》记载,公元前 600 年,尼布甲尼撒王统治时期,一条面包的价值相当于 350 条面包兑 1 盎司黄金。面包大小略小于 1 公斤,而不是我们今天缩小的面包。

这一历史记录是面包价格与黄金价格的比较,这为使用此方法计算黄金与面包价格提供了历史先例。

在过去的 100 年里,每盎司黄金的价格从 300 镑变化到 388 镑,因此一直是历史记录的良好参数。

1990 年至 2008 年,澳大利亚的面包成本上涨了 123%。相比之下,世界面包价格的涨幅还不到我们的一半(50-60%)。但这确实与我们在澳大利亚的独特地位有关,因为我们有垄断超市控制着我们的食品来源,而且计算仅基于现代澳大利亚的面包条

- 1997-98 年,黄金价格为每盎司 480 美元,面包价格为每盎司 1.60 美元或 300 条面包

- 2007-2008 年,黄金价格为每盎司 800 美元,面包价格为每盎司 2.50 美元或 320 条面包

- 2010 年黄金价格为每盎司 1360 美元,面包价格为每盎司黄金 3.50 美元或 388 条面包

数百年后,历史比率首次出炉。但这将是最终比率,我使用 388 比 1 盎司黄金。这可能意味着我们未来的食品价格将超过我们 100 年的历史最高纪录。

320-350 面包的稳定市场是政府稳定和繁荣时期的平均水平。低于 320 是通货紧缩时期,高于 350 则是通货膨胀时期。

因子 388 x1 的估计相当于遵循面包与黄金的比率成本。

- 2010 年黄金价格 1350 美元相当于 388 条面包,每条面包价格为 3.47 美元

- 2015 年黄金价格为 2,1425 美元,相当于 388 条面包,每条面包价格为 6.25 美元

- 2020 年黄金 5,000 美元相当于 388 条面包,每条面包价格为 12.90 美元

- 2020 年黄金 10,000 美元相当于 388 条面包,每条面包售价 25.90 美元

黄金价格是根据每年食品价格上涨计算出来的

- 2010年-2015年为10-15%

- 2015 年至 2020 年为 15% 至 50%

- 2020 年至 2030 年为 50%

这些估计只是基于在新的清洁技术发明之前,碳氢化合物冲击价格上涨所导致的食品价格上涨估计值。

以下是我对 2010 年 9 月 5 日 Wayne Sedawie 的预测

金币的历史

自从发明了货币以来,黄金就被用来铸造硬币。早在公元前 2000 年,金币就被认为是地中海贸易的命脉。幼发拉底河和底格里斯河之间的这些土地现在被称为埃及,这些硬币形状粗糙,通常是不同纯度的金块。

公元前 6 世纪,吕底亚(现今的西土耳其)铸造了第一批称重金币。希腊和罗马帝国紧随其后,铸造了一面刻有皇帝头像的金币。亚历山大大帝征服了波斯,并将 700,000 多金衡盎司的黄金带回希腊。

- 罗马大规模铸造了数亿枚金币,这些金币遍布包括英国在内的整个罗马帝国。

- 欧洲也生产了流行的黄金交易币

- 奥地利金达克特是一种直径为 40 毫米的大型硬币。

- 法国制造了著名的公鸡金币

- 俄罗斯铸造了数百万枚5 10卢布金币

- 英国生产了数百万枚金币和半金币

- 美国铸造了著名的印第安人头像和鹰金币,但在 1933 年的大萧条中,美国召回了所有的金币,并规定拥有金币为非法。

- 如今,澳大利亚是世界主要黄金生产国之一,金币由珀斯铸币厂和澳大利亚皇家铸币厂铸造

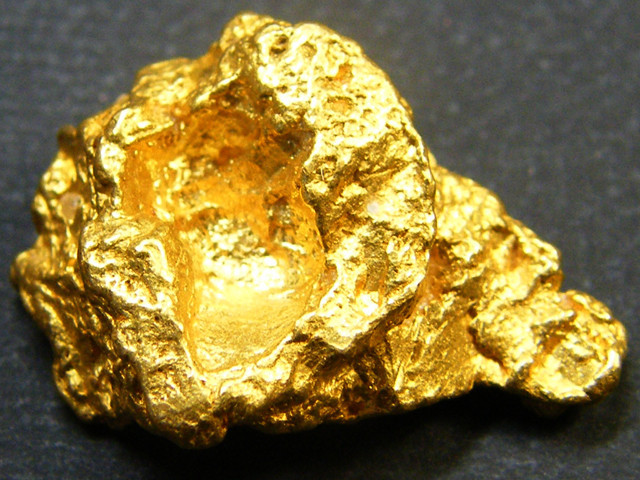

澳大利亚金块

拳击袋鼠

农历金币包括虎年金币和澳大利亚吉祥物考拉金币。

金币大多为一盎司、半盎司、1/10、1/20、1/25,甚至最小的也有0.5克

今天,了解金币的纯度很重要-

由于纯金较软,且硬币有时会受到严酷的处理,因此需要将其他金属与金混合,使硬币更加耐用,正常的磨损必须保持在最低限度。

克拉重量是公认的黄金纯度单位,相当于纯金的 1/24。

冶炼出来的纯金纯度达1000%。

克拉数与纯度之间的关系

- 24 克拉 = 1000 纯金

- 23 克拉 = 958.3 纯度

- 22 克拉 = 916.6 纯度

- 21 克拉 = 875.0 纯度

- 20 克拉 = 833.3 纯度

- 18 克拉 = 750.0 纯度

- 16 克拉 = 666.7 纯度

- 14 克拉 = 583.3 纯度

- 10 克拉 = 416.6 纯度

搜索Coin Encyclopedia

最新的文章

文章分类

Collection of articles providing lots of useful information on coins through the ages.

30文章数